Background and Opportunity

- Initial £10m acquisition of Thames House for an office and residential conversion planning play next to Borough Market in London

- JV with existing Revcap operating partner with significant local property and planning expertise

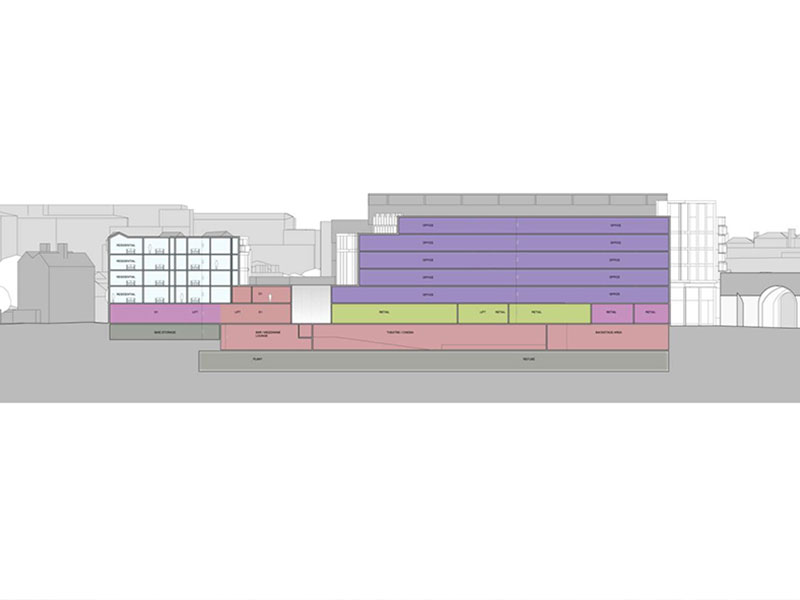

- Option subsequently secured on neighbouring 2.45 acre leasehold Vinopolis site to allow a comprehensive retail led regeneration scheme to be promoted across both sites

Transaction Progress

- The JV put together the professional team and progressed pre-application planning procedures on a speculative basis for this complex re-development

- JV worked up a planning application for a mixed use scheme of boutique retail and leisure, offices and residential of c. 200,000 sq ft

- During the planning process, the JV was approached by a number of parties to acquire its position

Current Status

- Transaction exited in 2015 to an institutional investor after a limited auction when the Thames House property and the Vinopolis option were sold

- The JV generated a very substantial equity return (3x+) without taking final planning and development risks